ev tax credit 2022 infrastructure bill

The new credits if Biden and Democrats finalize a. Electric cars and trucks made by nonunionized shops were eligible for 7500 in incentives.

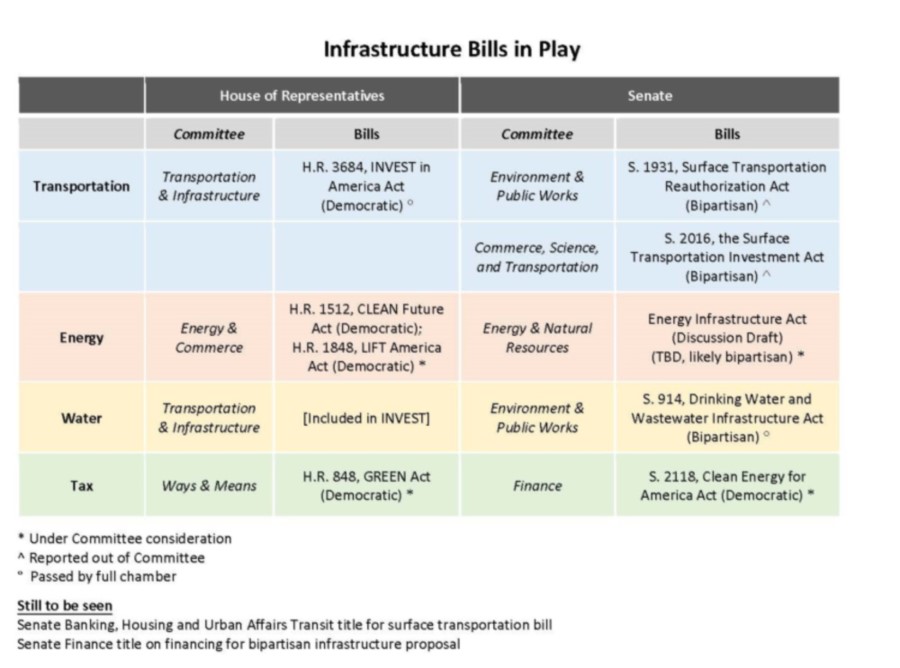

Legislative Analysis For Counties The Bipartisan Infrastructure Law

19 its a solid maybe.

/cdn.vox-cdn.com/uploads/chorus_asset/file/22682182/D8LI9_the_senate_infrastructure_deal_leaves_out_br_a_lot_of_climate_friendly_policies.png)

. As the bill is currently drafted a maximum credit of 12500 will go to consumers who purchase an American electric vehicle manufactured in the country and manufactured with unionized workers. Competitive grant program to strategically deploy publicly accessible electric vehicle charging infrastructure and other alternative fueling infrastructure along designated alternative fuel corridors. If you purchase the vehicle in 2022 then you can only claim the tax credit under the then-applicable rules on your 2022 tax return next spring.

The newrenewed tax credit is unknown. A maximum 12500 federal EV tax credit including a bonus for union-made vehicles appears to have survived the negotiation process and is now a likely part of the infrastructure bill. Meanwhile sedans hold steady with the same proposed price cap.

According to recent comments from Toyota North America the automaker expects. The bill has proposed to increase the federal tax credit for electric vehicles to 12500 from 7500. A new framework adjusted from the version the House presented in September allows for any vans trucks and SUVs with a price of up.

The stick of the new EPA regulations is made highly achievable with the carrot of expanded tax credits. 11th 2022 424 pm PT. Plant that operates under a union-negotiated collective bargaining agreement.

The logjam on Capitol Hill also means buyers of EVs from General Motors and Tesla remain. An electric sedan will not qualify for tax credits if the MSRP exceeds 55000. The bipartisan Infrastructure Investment and Jobs Act provides 75 billion to jump start Bidens goal of having 500000 EV charges nationwide by 2030.

This federal EV infrastructure tax credit will offset up to 30 of the total costs of purchase and installation of EV equipment up to a maximum of 30000 for commercial property and 1000 for a primary residence. The base credit goes up by 4500 if the vehicle is mad. Toyota Prius Prime Toyota EV Federal Tax Credit Toyota bZ4X.

Joseph Szczesny Executive Editor. It also underscores the need for Sen. As more electric vehicles reach dealer showrooms EV tax credits are stuck in a legislative limbo according to observers on Capitol Hill.

Discretionary Grant Program for Charging and Fueling Infrastructure 25 billion. The current 7500 is a tax credit that offsets your tax burden at the end of the year. A large part of the 12500 figure comes from 4500 for EVs made at unionized factories.

Congress passes 12 trillion infrastructure bill 12500 EV tax credit still awaits passage. As of Dec. For this purpose the bill provides a 7500 tax credit to anybody who buys US-made electric vehicles starting 2022 till 2026.

This means if your tax burden was less than 7500. Heres whats in the bipartisan infrastructure bill Electric vehicles The bill would provide 75 billion for zero- and low-emission buses and ferries aiming to deliver thousands of electric school buses to districts across the country according to the White House. Ago TaycanTurbo ETronSportback MX gone No tax filing in this year is for the 2021 tax year so only vehicles purchased in 2021 would apply.

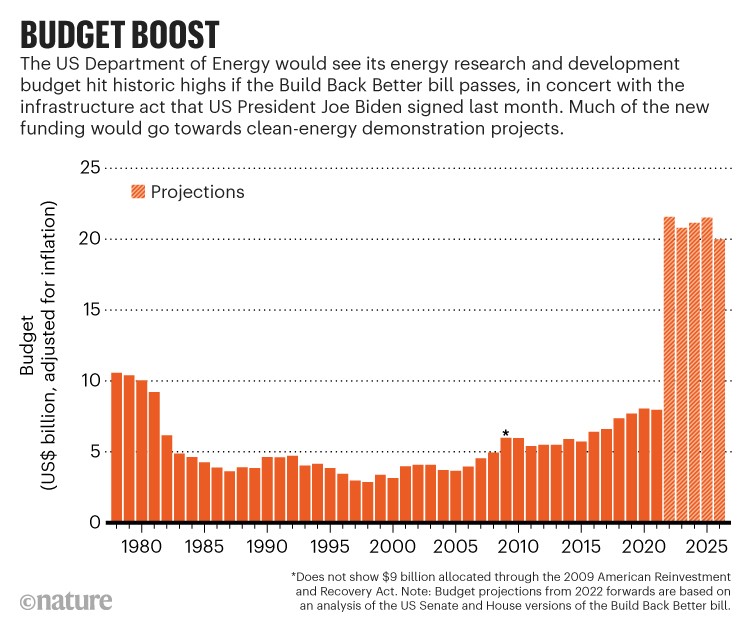

The newest iteration of President Joe Bidens Build Back Better bill proposes tax credits of up to 12500 for some electric vehicles if. The main 7500 tax benefit shifts from tax credit to refund and is for vehicles with batteries of more than 40 kilowatt hours meaning virtually every EV on sale now. There are two bills that have it-- one in the House and one in the Senate.

White House National Climate Advisor Gina McCarthy expressed confidence on Thursday that tax credits for electric cars would survive in a reworked Build Back. As proposed the Biden administration calls for expanding EV tax credits on some models to up to 12500 if certain criteria are met and allowing more people to qualify for those credits. Manchin to maintain support for a critical provision contained within Build Back Better.

E at a US. Another blow to the infrastructure bill is that the Build Back Better bill was put on hold as legislators attempt to lower costs. The 175 trillion Build Back Better Act.

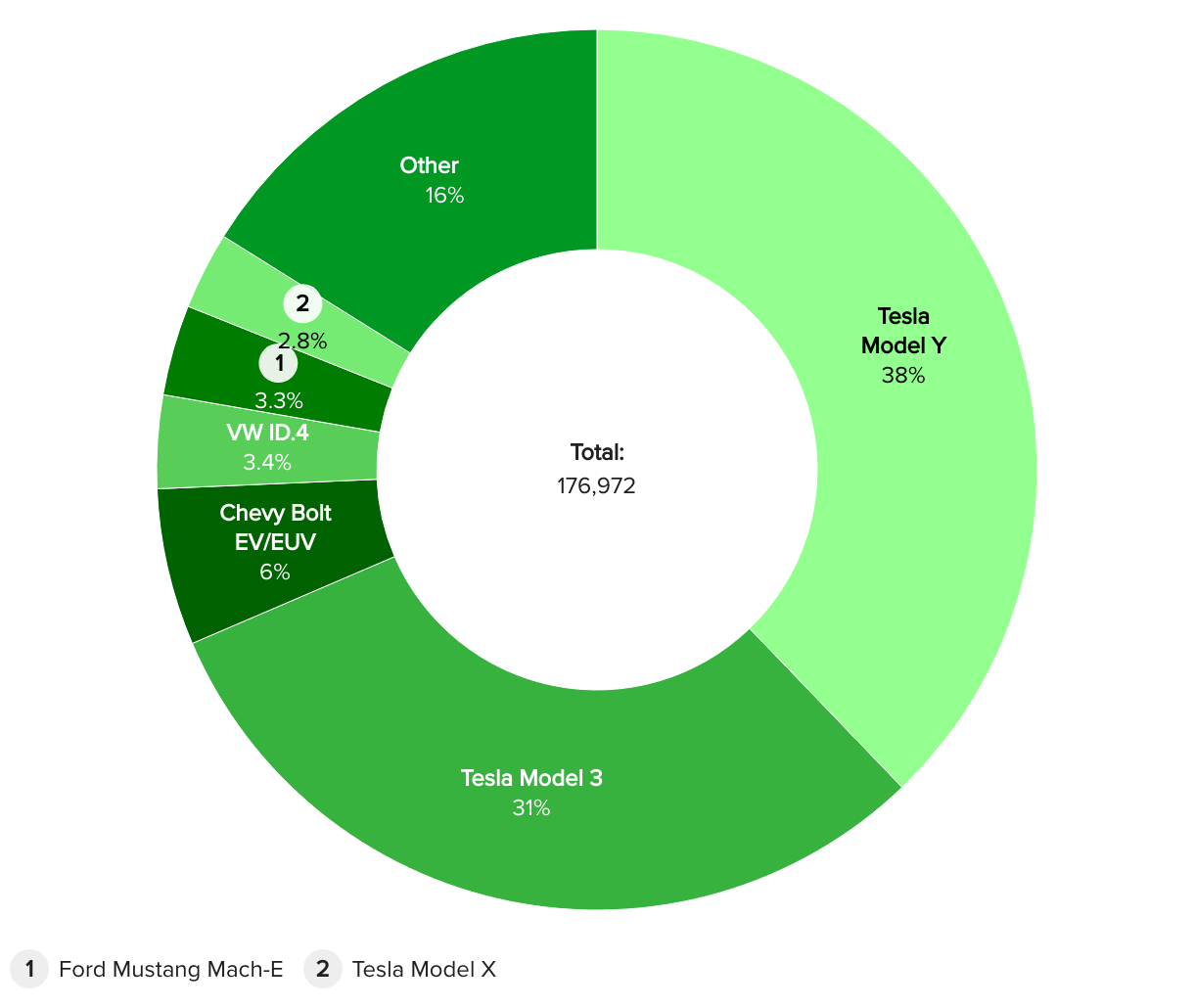

The Build Back Better bill includes a 12500 EV tax credit up from the current 7500 available to qualifying cars and buyers. Sales of electric vehicles like the Ford Mustang Mach-E have been on the rise. January 20 2022 1151 AM PST.

Both of the new bills have refundable tax credits while the prior one was non-refundable. January 25 2022. At least 50 percent of this funding must be used for a community grant program.

The bill also offered record incentives for used electric cars and it would have removed a provision.

Ev Tax Credits In Biden S Build Back Better Act Will Help Sell More Cars Than New Chargers In Infrastructure Bill

Infrastructure Bill Could Rev Georgia S Electric Vehicle Market Despite No Votes From Gop Wabe

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

What S In Biden S Infrastructure Plan The New York Times

Infrastructure Bill Could Be Strongest Ever U S Climate Action If Congress Acts

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

/cdn.vox-cdn.com/uploads/chorus_asset/file/22682182/D8LI9_the_senate_infrastructure_deal_leaves_out_br_a_lot_of_climate_friendly_policies.png)

The Senate Infrastructure Deal Leaves Much Of Biden S Climate Plan For Reconciliation Later Vox

Latest On Tesla Ev Tax Credit March 2022

Climate And Clean Energy Policy State Of Play Insights Holland Knight

The Infrastructure Plan What S In And What S Out The New York Times

Latest On Tesla Ev Tax Credit March 2022

Considering An Electric Car The Build Back Better Bill Could Save You Thousands Cbs News

Here S President Biden S Infrastructure And Families Plan In One Chart The New York Times

What Biden S 2 Trillion Spending Bill Could Mean For Climate Change

Rebates And Tax Credits For Electric Vehicle Charging Stations

Latest On Tesla Ev Tax Credit March 2022

Is House Ev Tax Credit Proposal Targeting Tesla Huge Increase For Unions

Reconciliation Proposals Support Both Electric And Hydrogen Vehicles Third Way